By Allison Perrine

MIDDLETOWN – With its municipal budget for 2020 approved, the Middletown Township Committee wants to remind the public of its user-friendly tax receipt calculator that shows residents exactly where their money is going.

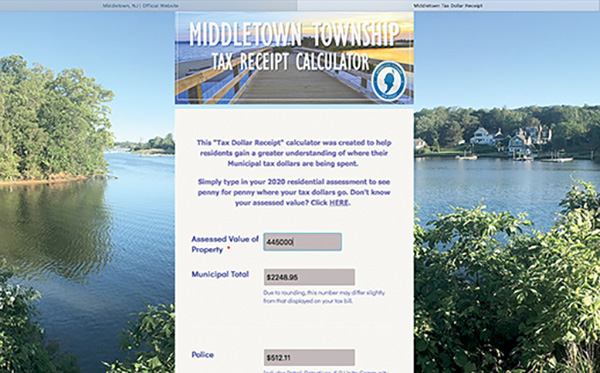

It’s pretty simple: By visiting the website, middletownnj.org/mytaxdollars, residents can enter their 2020 residential assessment and discover where each penny of their municipal tax dollars goes, with explanations and details. Anyone unsure of their assessment can also find it on the site.

“This is really something that I’m very proud of, the township committee is very proud of, because it really gives an incredibly transparent view of your tax bill,” said Mayor Tony Perry. “Every municipality in the state of New Jersey should be required to provide something like this.”

The idea to create the page came as officials brainstormed ways to make tax bills easier to read and understand for residents. It was set up by members of the public information office and tech department in 2019 but underwent some renovations in 2020 to give it a more polished look. Most people have questions about their bills and where the money is going, said Perry. The municipality keeps just about 21 percent of taxes collected; the school board gets 62 percent.

According to the calculator, the average Middletown resident with a home valuation of $445,000 will pay about $2,249 in municipal taxes. Of that total, $512 will go to police, $418 to public works, $99 to the public library, $25 to fire services and much more.

“When somebody scrolls down this list, this receipt, and they see that their fire department on the average assessed value only costs them $25 a year, that’s an amazing statistic that I want the people of Middletown to know,” said Perry. “Who wouldn’t pay $25 to have a fire department?”

The New Jersey State League of Municipalities recognized the township in 2019 with an innovation in governance award for establishing the platform, said Perry. The National League of Cities also recognized the township for its efforts to explain its tax bill to residents, and the mayor of Paterson, Andre Sayegh, who is a friend of Perry’s, asked representatives of his city to create the same platform once he learned what Middletown created.

The feedback has been “incredible” from township residents as well, the mayor said. “It’s very simple and anytime government can provide greater insight into how they’re spending the hard-earned dollar of the taxpayer, they should,” said Perry.

The 2020 Budget

The final municipal budget for 2020 was unanimously approved at the June 15 township committee meeting. It anticipates $83.1 million in total general revenues, with $56.1 million to be raised by taxes for support of the municipal budget.

Due to the pandemic, revenues were reduced in this year’s budget and “large adjustments” had to be made, according to Colleen Lapp, chief financial officer. That includes decreasing anticipated costs in the introduced budget, like fees and permits, from $475,000 to about $373,00; court fines and costs from $675,000 to $375,000; and parking meter fees from $600,000 to $294,000.

But “despite the global pandemic,” the committee was able to deliver a “fiscally responsible budget” with a 0 percent municipal tax rate increase without reducing services, said Perry. “This budget represents the fiscal solvency and stability to withstand this crisis and lost revenues, however it hinges on Middletown and the State of New Jersey getting back on its feet.”

The article originally appeared in the July 16 – 22, 2020 print edition of The Two River Times.